Customer Loyalty Platform Overview

Bravo’s Customer Loyalty Platform helps stores boost revenue by offering Customer Rewards, Star Ratings, and Loyalty Reports based on customer performance.

Last Updated: 4/25/2025

Table of Contents:

Watch a video on the Customer Loyalty platform for Pawn below

Bravo Customer Reward

When the Customer Loyalty Platform for Pawn is active, Customer Reward helps employees offer loyal customers better loan rates or adjust amounts for less reliable customers.

Customer Reward is calculated based on customer data, not item data. In Bravo, selecting a customer generates a loan amount suggestion based on either Lifetime Value or Redemption Rate, as defined by the owner or manager.

For configuration details, see Customer Loyalty Platform - Configuration .

When selecting a customer in Bravo, the system suggests a Customer Reward using:

- Redemption Rate – This is the percentage of the total redeemed amount over the total loaned amount.

Example: If a customer has 10 loans totaling $1,000 and redeems 3 loans worth $200, the redemption rate is 20%, differing from the Loyalty Report's 30% based on quantity.

- Lifetime Value – LTV indicates a customer's profitability compared to others, factoring in past transactions.

NOTE: This value relates to the Customer Rank on the Loyalty Report, calculated as the total number of customers minus the customer rank divided by the total number of customers.

You can set which metrics determine higher or lower loan amounts across ten customer brackets, defining a Pawn Multiplier for each.

The Start value marks the lower limit for applying the selected method (Redemption Rate or LTV), with a fixed number of 10 levels.

The Pawn Multiplier adjusts the loan amount from the usual Estimated Pawn Amount, with limits of +/- 100%.

The estimator recommends a Customer Reward Amount based on the customer's metrics and the Pawn Multiplier.

Example: A customer with a 97% Redemption Rate in the top bracket gets a 20% increase, raising the Customer Reward Amount from $80.00 to $96.00. A 55% Redemption Rate would yield no reward.

Customer Star Rating System

With the Star Rating System, Bravo rates customers from 0 to 5 stars based on transaction history.

- Increasing your loan base by 10% through Customer Rewards could add $15,000 to your revenue, not including new business from enhanced loyalty.

- Bravo Customer Rewards can also calculate negative percentages to mitigate risks with customers who have lower redemption rates.

The Customer Loyalty Platform for Pawn assigns customers a star rating (0-5) based on Redemption Rate or Lifetime Value (LTV), providing a quick visual of their contribution to your store's profitability.

The rating is displayed under the customer photo in Bravo:

To configure, refer to Customer Loyalty Platform - Configuration .

When a customer is selected in Bravo, their star rating is calculated using:

- Redemption Rate – Calculated as the total amount redeemed divided by the total amount loaned. For example, a 10% rating means the customer redeemed 10% of their loans' value.

Example: A customer has 10 loans totaling $1,000. If 3 loans worth $200 are redeemed, the redemption rate is 20%, unlike the Customer Loyalty Report which would show 30% based on quantity.

- Lifetime Value – Reflects a customer's profitability over their history compared to others. A 10% rating indicates better profitability than only 10% of customers.

NOTE: This ties to the Customer Rank on the Customer Loyalty Report to determine a customer's percentile.

Stars are assigned based on this table:

| Stars | Start | End |

| 0.5 | 0.00% | 10.00% |

| 1 | 10.10% | 20.00% |

| 1.5 | 20.10% | 30.00% |

| 2 | 30.10% | 40.00% |

| 2.5 | 40.10% | 50.00% |

| 3 | 50.10% | 60.00% |

| 3.5 | 60.10% | 70.00% |

| 4 | 70.10% | 80.00% |

| 4.5 | 80.10% | 90.00% |

No Rating

New customers or those without transaction history will not have a star rating, displaying a "No Rating" graphic below their photo.

Once sufficient data is available, stars will be assigned based on either LTV or redemption rate.

Customer Loyalty Report

A Customer Loyalty Report analyzes customer performance through metrics like redemption rates and lifetime values. Higher values indicate customers who generate more revenue, suggesting they may deserve more favorable loans.

This report outlines customer activities in your store(s) and includes three main components:

How to access the Customer Loyalty Report?

To access the report, view a customer's profile and click the "Customer Loyalty Report" button on the right.

- Find the button on the right side of the profile.

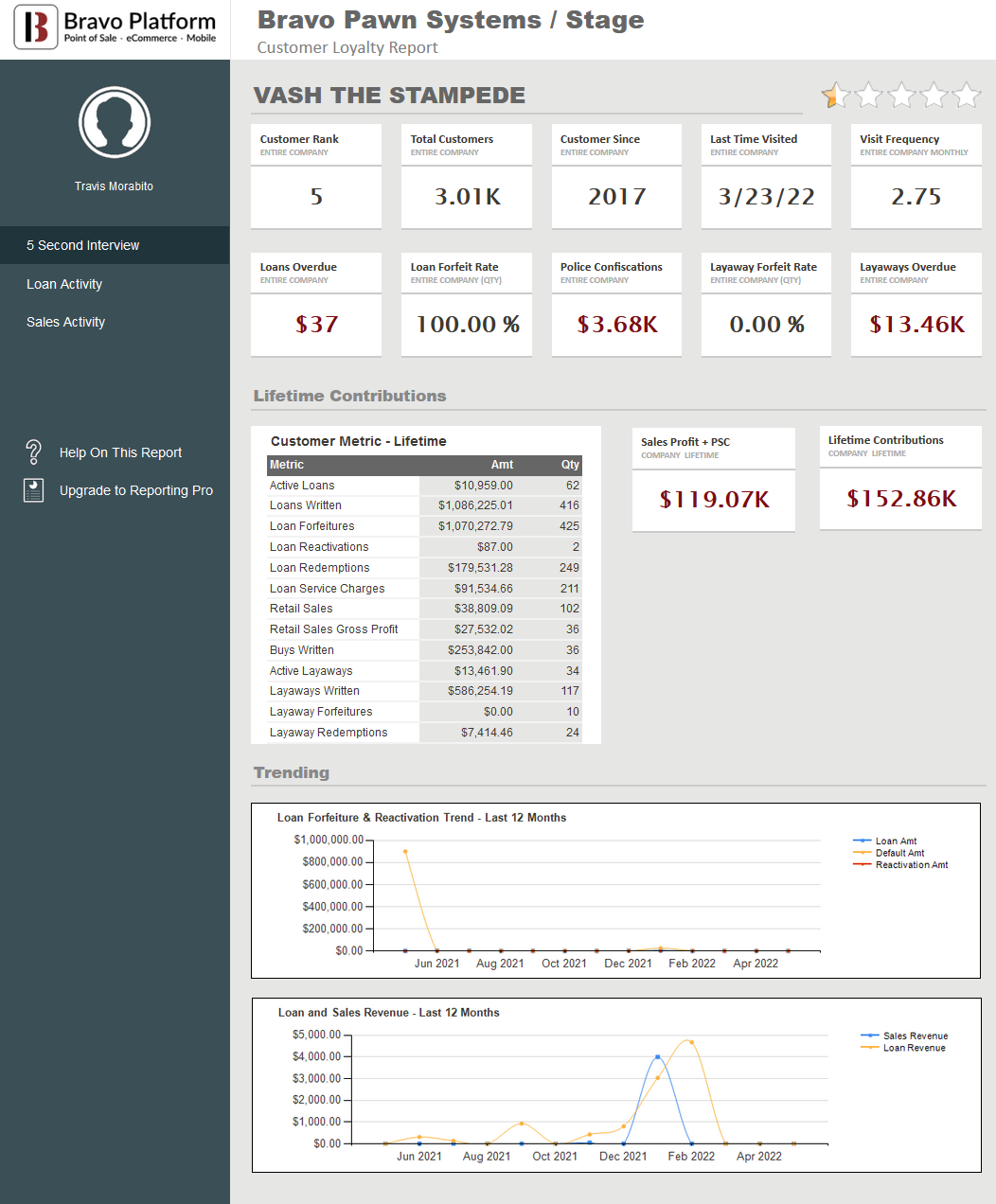

5 Second Interview

- This section compares the customer to others in your store.

- Lifetime Contributions - Includes pawn service charges, retail sales, and profit from buys/forfeited loans.

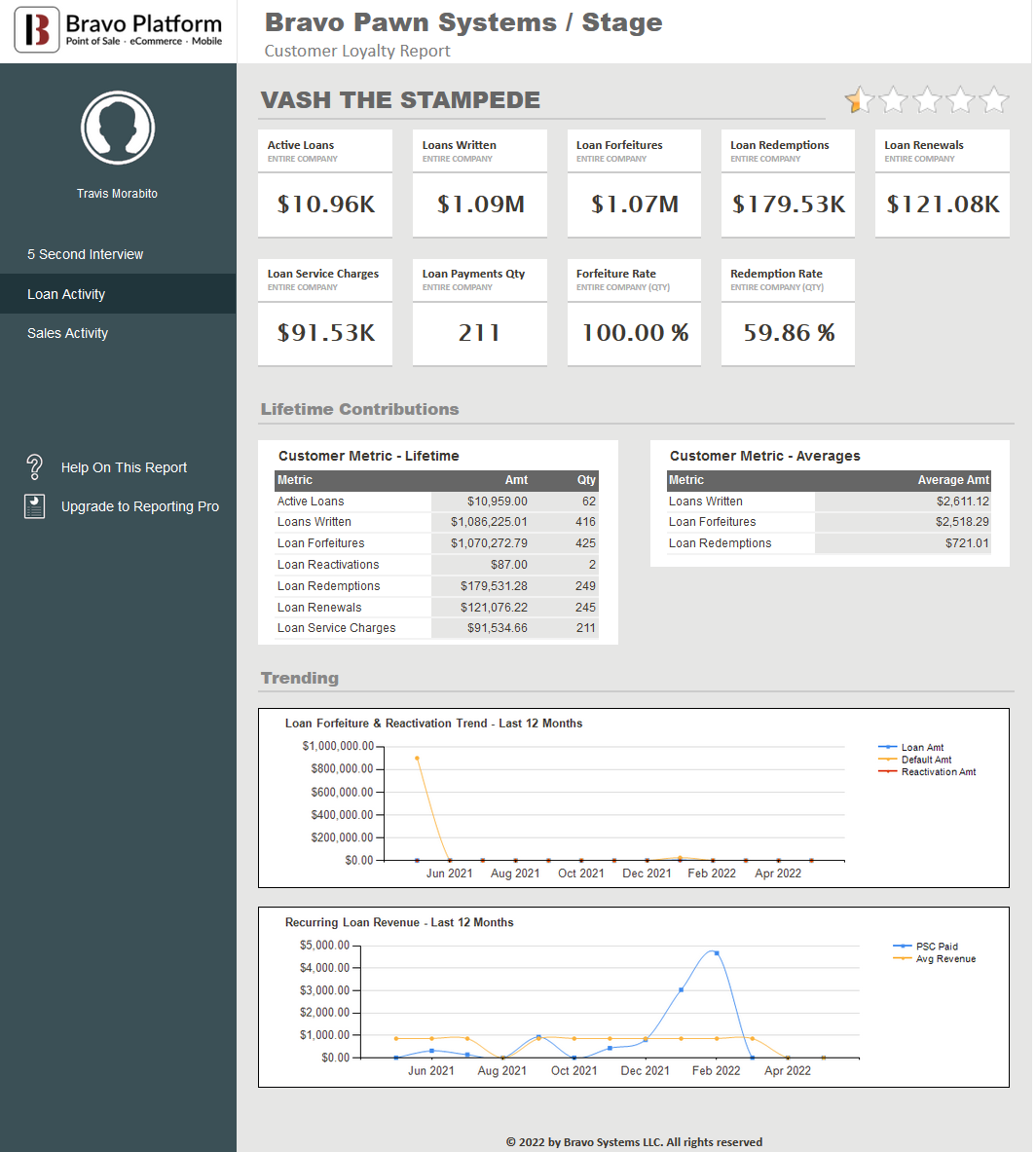

Loan Activity

- Details any loan transactions the customer has made.

In the Trending section, you will find two graphs:

- Loan Forfeiture Trend - Last 12 Months

- Recurring Loan Revenue - Last 12 Months

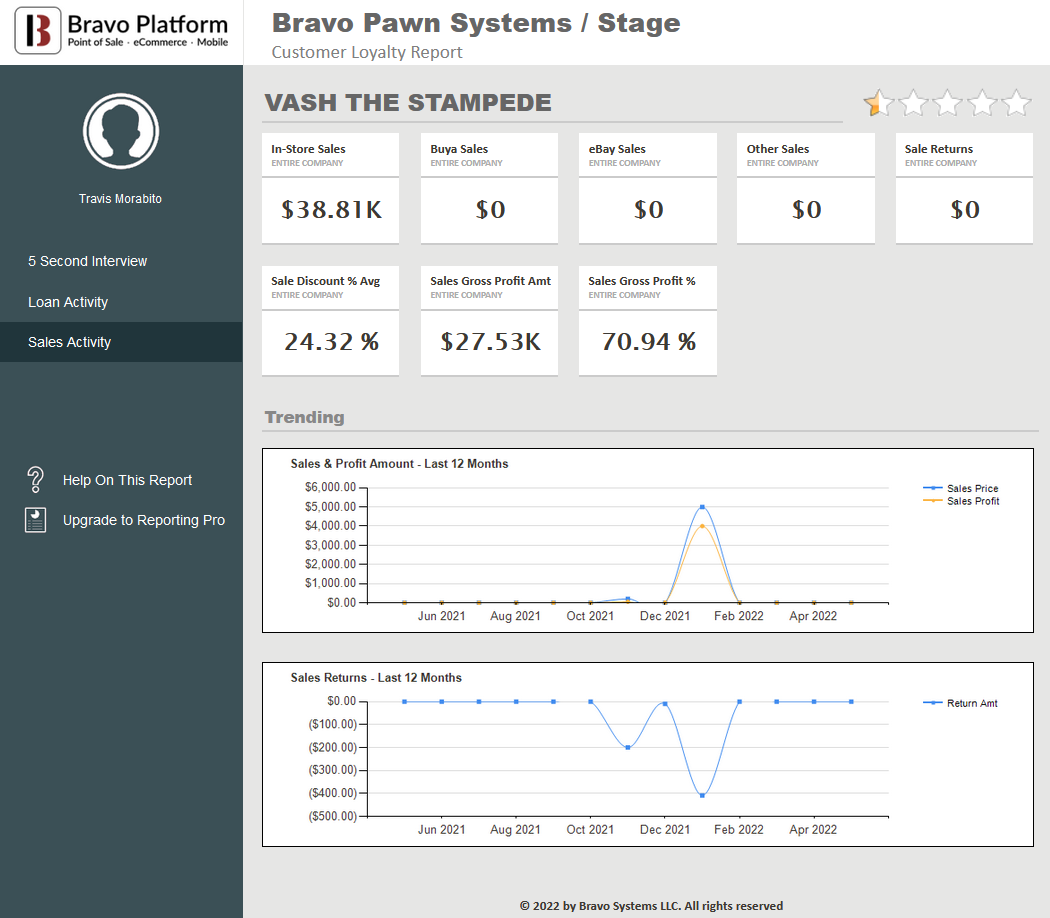

Sales Activity

- Shows customer purchases and returns across all platforms.

In the Trending section, you'll see:

- Sales & Profit Amount - Last 12 Months

- Sales Returns - Last 12 Months