Roll Over Process

You will learn how to perform the Roll Over Process in Bravo, which prepares your store’s accounting and reporting for a new business year.

If you have customers that always renew their loan after it expires, the Roll Over process might be the feature for you. This feature allows a store to renew a contract for a customer, extending the time the store will hold the items for the customer, allowing the customer to, at a later date, arrive and pay for this renewed contract. No money lost. No items melted. If the renewed contract is not paid on, the loan expires.

Index:

No action from customer:

Roll Fee paid:

Renew or Redeem:

Concerns & Considerations:

Edit Roll Over Flag:

Pay Roll Fee:

Loans to Roll Over:

Roll Over Loan:

New loan:

Edit Roll Over checkbox:

Roll Over Notice:

Print Roll Notice:

Roll Over Loan:

How to get it:

Contact your Bravo representative.

Life of a Roll Over Loan:

No action from customer:

New loan written and enabled for roll over. No action from customer, Loan ages to be ready for notice, Roll Over Notice is sent. No action from customer loan is Rolled Over. New loan created from the Roll Over has all the previous loan interest and fees summed up in a “Roll Over” fee. No action from customer, Loan ages to be ready for final notice, Final notice sent. No action from customer, Loan ages and then is expired.

Roll Fee paid:

New loan written and enabled for roll over. No action from customer, Loan ages to be ready for notice, Roll Over Notice is sent. No action from customer loan is Rolled Over. New loan created from the Roll Over has all the previous loan interest and fees summed up in a “Roll Over” fee. Customer pays the “Roll Over” fee, Loan is now enabled for another Roll Over.

Renew or Redeem:

New loan written and enabled for roll over. No action from customer, Loan ages to be ready for notice, Roll Over Notice is sent. No action from customer loan is Rolled Over. New loan created from the Roll Over has all the previous loan interest and fees summed up in a “Roll Over” fee. Customer renews or redeems the loan paying the roll over fee, notice fee and any interest and fees accrued in the present loan.

Roll Over column:

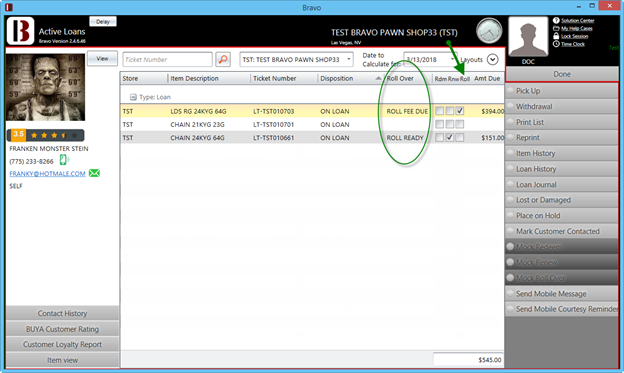

There is a new column “Roll Over” that can be added to “Active Loans” and “Loans/Buys” screen via Column Chooser. Below are the four possible Roll Over statuses:

Roll Ready = Roll Over amount paid and loan can auto-renew again. Flag is set and no fees. New loans have this status.

Rolled Over = this displays on the previous loan showing what caused the renewal to happen.

Roll Fee Due = Loan has auto-renewed and there are fees due from that process.

Roll Expired = Loan auto-renewed then expired.

Blank = Loan not enabled for Roll Over.

Concerns & Considerations:

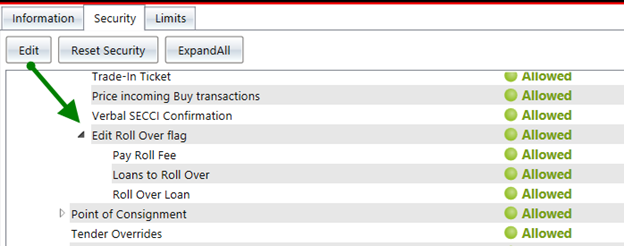

Security:

There are four new security bits with this feature. They are located in: Main Menu -> Transactions -> Point of Pawn -> Edit Roll Over Flag

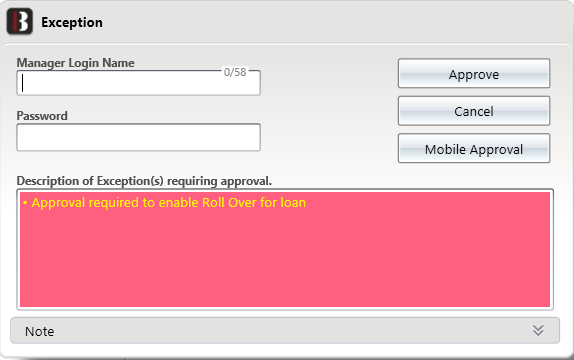

Edit Roll Over Flag:

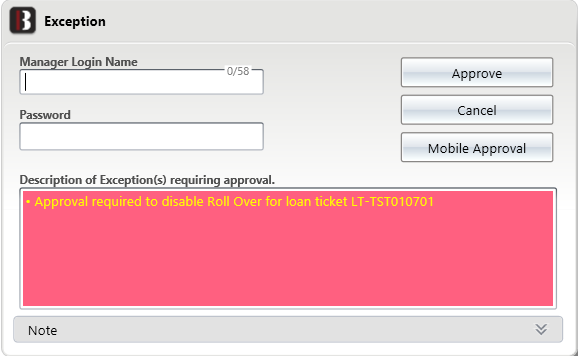

When a loan is enabled for Roll Over, the user with the ability must sign in with their user/pass to approve this action. An exception is written and can be reviewed in the general exception report.

Pay Roll Fee:

After a loan is rolled over, the fees for this process are added to the renewed loan created in this process. If the customer wishes to pay only the roll over fee, the employee will need this security bit enabled in order to perform the transaction of Pay Roll Fee. All employees in the store should have this bit enabled.

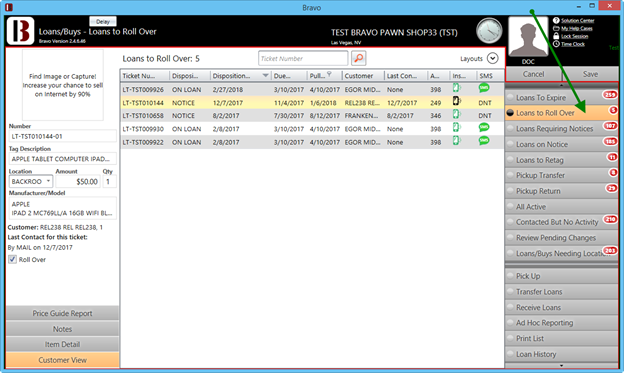

Loans to Roll Over:

This will allow the user to see what loans are past their notice period and ready to roll over.

Roll Over Loan:

This will allow the user to Roll Over the loan into a new loan with roll over fees due.

Efficiency:

Once the feature is enabled, users will be prompted with the loan detail window after adding the first item to a pawn ticket. This may be considered “too many steps” for some pawnbrokers.

No MLA loans:

Roll Over cannot be enabled for a loan that is qualified for MLA.

Best Use and Steps:

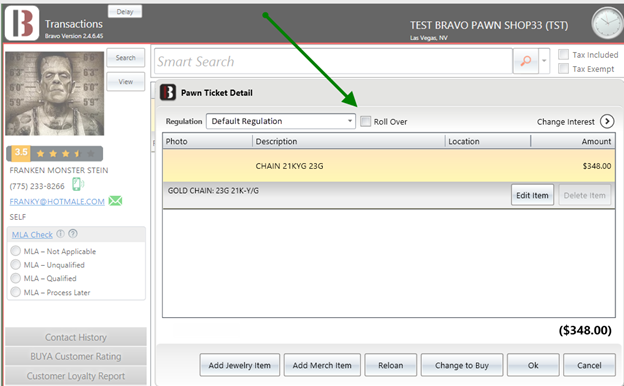

New loan:

Once enabled for the user, there will be a noticeable change to the process of writing a new loan. After completing the first item of a loan, the “Pawn Ticket Detail” window will be shown. This will have a checkbox at the top to enable Roll Over for the loan. Roll over can be enabled or disabled at any time in the loan writing process. By default all new loans are not enabled for Roll Over.

Roll Over is not available for MLA qualified loans.

Once the loan is complete and the transaction is saved, the clerk will have to input their username and password to approve the loan being enabled for Roll Over.

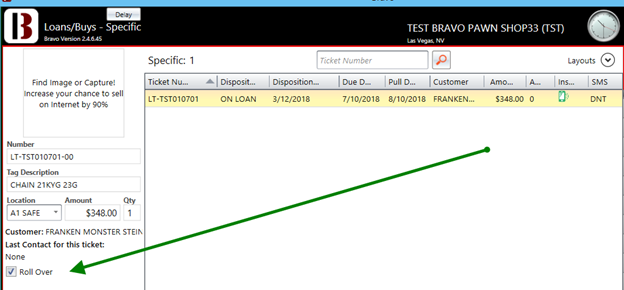

Edit Roll Over checkbox:

At any time after the loan has been written, the Roll Over checkbox can be disabled or enabled from the “Loans/Buys” screen. Just pull up the loan and choose to enable or disable Roll Over.

Changing the Roll Over flag will require username and password.

Roll Over Notice:

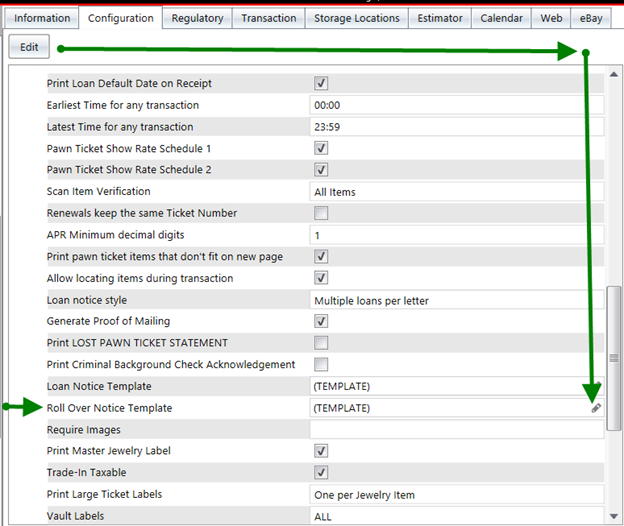

There is an option to print a notice for loans past their due date and soon to Roll Over. The notice can be found in System Config -> Configuration tab -> POP Config -> Roll Over Notice Template.

The procedure to edit the Roll Over notice is the same as the “Loan Notice Template”. https://support.bravopawnsystems.com/hc/en-us/articles/219917887-Custom-Loan-Notice-Templates

Print Roll Notice:

If a Roll Over enabled loan has reached the notice period. Roll Over Notices have their own button in the Loans/Buys screen called “Roll Overs Requiring Notice”. Same as printing notices for loans. Select the loans you wish to print Roll Over notices for, then right click or use the button on the right side of the screen to “Print Roll Notice”. No electronic notices are supported for Roll Over Notice at this time.

Roll Over Loan:

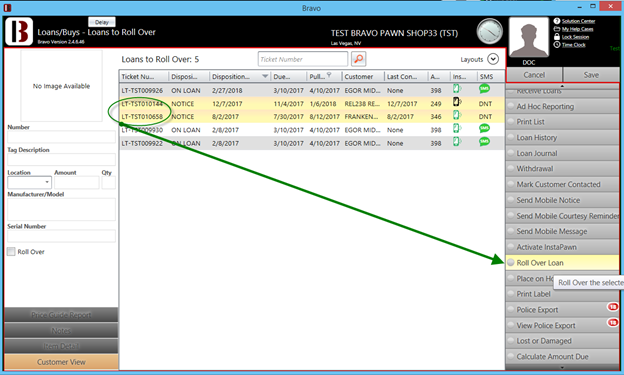

After the Roll Over notice has been sent, the loan ages to be available for Roll Over. In the Loans/Buys screen, there is a new task button named “Loans to Roll Over”. This functions similar to expiring loans, except you need to have a till open before you can Roll Over a loan. Each Roll Over transaction will amount to $0.00, but the till needs to be open as each Roll Over is similar to a renewal.

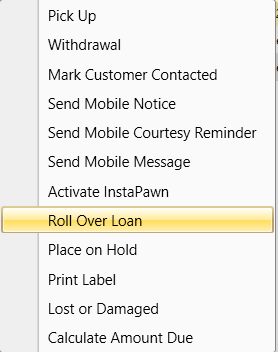

Highlight the loans you wish to Roll Over, then click on the button Roll Over Loan.

Alternatively you can right click on the selected loans, then left click on Roll Over Loan.

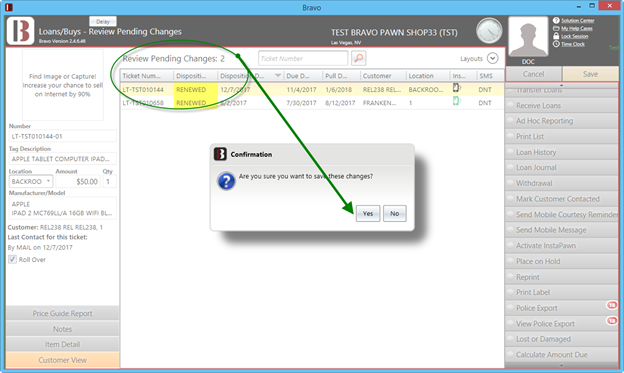

Saving the Roll Over selections will show pending changes as “RENEWED” disposition. Roll Over process renews the existing loan into a new loan with a “Roll Over” fee added to the new loan. Once you are satisfied with the selected changes, choose Yes to save and Roll Over the selected loans. Nothing will print.

Void/View:

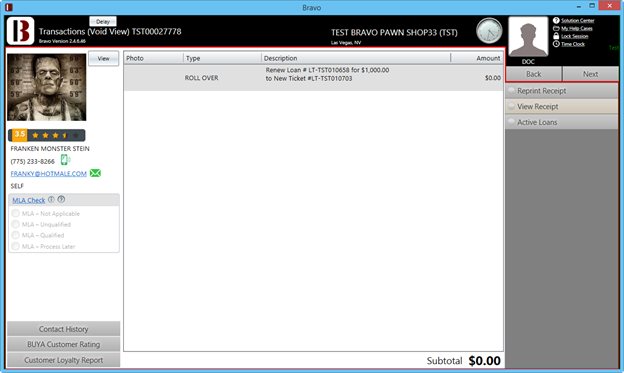

You can actually look up a Roll Over transaction in Void/View and even void the Roll Over if the need arises. If a customer has multiple loans being Rolled over, those Roll Over loans will be in one transaction.

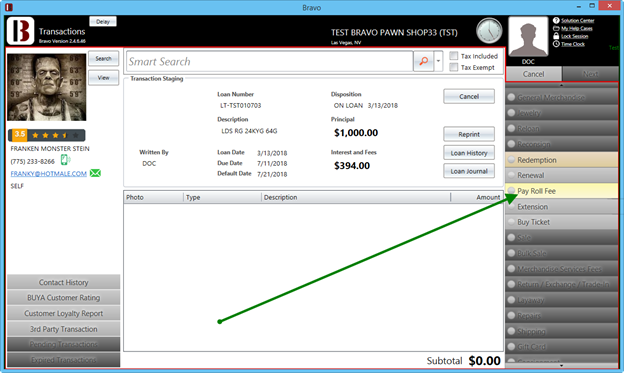

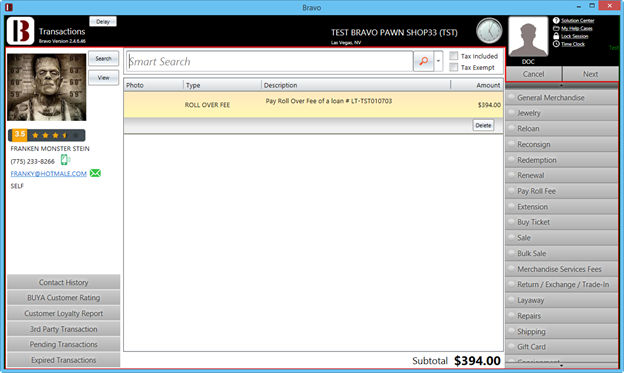

Pay Roll Fee:

After a loan has rolled over, it is possible to pay only the Roll Over fee of the new loan. This allows the customer to catch up on payments in smaller increments and enables the loan to be Rolled Over again. A new button has been added to the transaction screen called “Pay Roll Fee”. Works similar to Renewal or Extension, but does not extend the due or forfeit date of the loan.

Active Loans:

Two additions to the Active Loans screen. “Roll Over” added to the Column Chooser and a new checkbox to calculate Roll Over fees due on a specific loan.